A proposed levy lid lift for unincorporated areas of Whitman County would collect another $1.4 million a year for gravel road maintenance, additional road crew workers and newer grading equipment as officials say current property taxes have struggled to keep up with inflation.

Public Works Director Mark Storey said the repair and upkeep of the county’s approximately 1,100 miles of gravel roads would receive the most new funding. As material and labor costs have increased, the road division has started cutting back on how many miles of road it restores each year.

“My vision for it is really put more money in the gravel system,” he said, adding, “If I were to say there’s one thing that this levy lift is about, it’s about gravel roads. Our paved road system is in pretty good shape.”

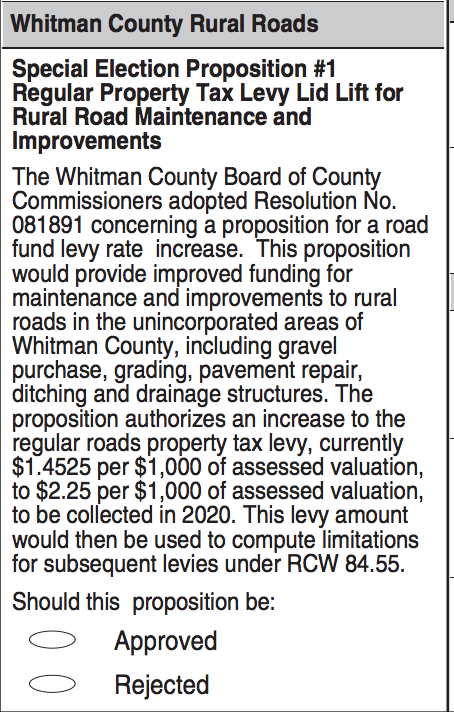

The proposed levy lid lift would raise the property tax rate from $1.4525 per $1,000 of assessed property value to $2.25 per $1,000. Now, the owner of a $200,000 home pays $290 a year. If the lid lift passes, the rate would increase by about $160 a year.

The county Auditor’s Office reports the levy lift will go before about 4,500 to 5,000 voters residing in the unincorporated county. The levy lift requires a simple majority to pass and with a corresponding turnout of 3,666 unincorporated voters in the 2018 general election, about 1,466 voters have to participate to certify the results.

Storey wrote a memo for the county commission outlining his general priorities for funding road operations, new personnel and other investments. Of the new $1.4 million in funding, about $300,000 would go toward the purchase of gravel.

Another $250,000 would go to hire additional road workers. County road employees have decreased from 92 to 74 since about 2000. Storey says he would like to add at least three positions.

The road division now receives about $2.5 million a year from property taxes and another $4.5 million from state gas taxes. Storey said voters living in the unincorporated areas can decide if they want to spend more money to ensure the gravel road system has longterm funding for maintenance work.

State law limits annual property tax growth to 1 percent a year while Storey said county costs often increase by 3 to 5 percent a year with inflation. Harsh winters and aging equipment have also led to tighter budgets, increasingly spending into reserves the past three years.

“Do [voters] want to invest a little more in their roads and have good roads?” he asked. “Or do they want to continue in the direction we’re headed, which is pretty clear … we are going to have less buying power?”

Storey noted Whitman County receives more than $2 back from the state in gas taxes for every $1 collected locally, so the area already gets some subsidizing on gas tax funding. He expects those funds to plateau or drop as drivers around the state increasingly turn to hybrid vehicles or mass transit.

To acquire gravel, the county contracts private crews about $5-6 a ton to crush rock at county-owned or leased quarries. The levy lift would likely double those operations to increase the gravel available for road restoration work.

Storey explains the county aims to resurface most gravel roads every seven to eight years. Busier routes might get new gravel every five years or so. Recent budget limitations have left some roads waiting 10 to 11 years for new gravel.

“We’ve cut back on any extra work unless we have to go do something,” he said. “If this trend continues, we’re going to have to make bigger cuts.”

Snow removal and other winter operations have also taken an increasing toll on the budget, Storey said. Unpredictable weather can strain staffing hours and the harsh conditions often break down equipment.

Aging graders and other heavy equipment also add to repair costs. Some of the proposed funding would go toward investing in newer graders

“Winter just sucks the life out of the fleet,” he said. “It’s not that we’re abusing them. It’s just that hard, heavy use for a couple of months just beats the heck out of them.”

In 2008, the county spent a record $1 million on snow removal. Storey said the county has already spent $800,000 this year — with November and December still to come.

County commissioners approved putting the levy lid lift on the Nov. 5 ballot back in August. See our full Fall 2019 Voters Guide.

With the additional funding, Storey said, the county could also get out ahead of other infrastructure needs. He would like to replace aging culverts or bridges more proactively. He would also expand chip seal and patching work while also treating some roads with a base stabilizer to improve their lifespans.

The county has started digitizing its road system for a long-awaited Geographic Information System and is running surveys on road usage to confirm which roads see the most traffic. Storey said those tools will help county road supervisors keep better track of needs and priorities.

But he also knows inflation will keep outpacing tax revenue while state and federal agencies continue to impose new roadway standards for upkeep or signage. He said he believes it’s time voters help determine some of those local priorities.

“I’m not a pro-new tax person, but you also get what you pay for,” he said. “That’s the other side of that coin. If there aren’t enough resources to take care of that road system then the people should weigh in. Do they want that road to be better and pay a little bit more? Or do they want that road to not be so good and pay a little less. That’s really the whole decision here.”

What can be done about those using these roads recreationally? 4×4’s, dirt bikes and others tearing up the roads they don’t live on. I don’t want to pay for maintenance when it will be vandalized by outsiders and no one held accountable.