Two area school boards have put replacement levies with rates above the state’s legal cap on the Feb. 12 special election ballot with hopes that lawmakers will raise those limits to provide additional funding for local educational programs and operations.

Both Oakesdale School District and Colton School District have asked for levies above the current cap. But administrators note they will only collect the legal $1.50 per $1,000 of assessed property value if the Legislature does not manage to raise the limit.

Lamont School District is also on the Feb. 12 ballot, requesting the maximum levy rate of $1.50 per $1,000.

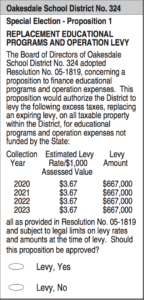

Oakesdale Superintendent Jake Dingman wrote via email that the district is seeking a replacement levy of $3.67 per $1,000 of assessed property value for a total of $667,000. That money supports advanced placement classes, after school programs, athletics and other uses.

“Public schools are not fully funded by the state, even with the ‘new’ funding passed in legislation with the McCleary decision,” he wrote. “Schools have been dependent on local support for many years and have been able to offer excellent programming because of the local support.”

“Public schools are not fully funded by the state, even with the ‘new’ funding passed in legislation with the McCleary decision,” he wrote. “Schools have been dependent on local support for many years and have been able to offer excellent programming because of the local support.”

Dingman noted that while the rate is higher than the state cap, the total funding remains the same as what voters previously approved three years ago. The 2016 levy passed with 65 percent approval.

The school district serves about 140 students from preschool through 12th grade, Dingman wrote. The proposed levy would impact the taxes of approximately 540 residents.

Dingman provided an extensive list of educational programs funded in part or total by the local levy including daycare services, school lunch programs, art and music classes, athletics opportunities and college prep courses. The levy makes up 21 percent of the district’s budget.

“If this levy is supported, these programs will all continue to grow, and new opportunities sought,” he wrote. “If the levy is not approved, nearly all of these programs would cease to exist.”

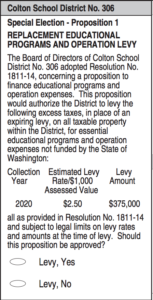

Colton Superintendent Paul Clark wrote via email the school board had proposed a levy of $2.50 per $1,000 of assessed property value to replace a levy from last year after changes to state funding levels. The levy would raise a total of $375,000 in 2020.

“Because state funding has been unpredictable in recent years and we have had a reduction in our local control with levies, we have fewer revenues coming in per student than we predicted with last February’s election,” Clark wrote, adding, “The need for this funding is critical.”

“Because state funding has been unpredictable in recent years and we have had a reduction in our local control with levies, we have fewer revenues coming in per student than we predicted with last February’s election,” Clark wrote, adding, “The need for this funding is critical.”

The levy helps pay for extracurricular programs, early learning, facility maintenance and vocational classes, he wrote. Voters approved the previous replacement levy by nearly 75 percent last year.

The school district serves approximately 180 students and the levy would impact taxes on about 600 residents. Clark noted that even with the above-cap rate of $2.50 per $1,000 of property value, voters would still pay less in school taxes next year than in 2018.

Here’s a recent Lewiston Tribune story on how the district is looking at bringing in less tax revenue and why its running a one-year levy.

The Gazette also has a story on the upcoming levies.

Dingman and Clark encouraged anyone with additional questions to contact the districts for more information.

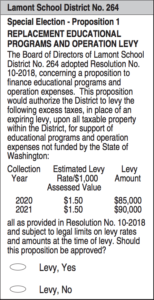

Updated: Feb. 7 — Lamont Superintendent Todd Spear responded via email that the district has asked for a replacement Educational Programs and Operation Levy of $1.50 per $1,000 of assessed property value, the maximum currently allowed. The levy would replace the previously approved levy rate of $3.96 per $1,000.

“This is a replacement levy, at a much lower rate, just with a different title,” he wrote, adding, “Public schools are not fully funded by the state even with the additional dollars provided by the state following the McCleary decision.”

“This is a replacement levy, at a much lower rate, just with a different title,” he wrote, adding, “Public schools are not fully funded by the state even with the additional dollars provided by the state following the McCleary decision.”

Spear explained the levy supports basic needs as well as extracurricular activities, counseling services, enrichment programs, paraeducators and other critical resources. Without the continued levy support, some of those programs would likely cease or offer reduced services.

The levy would potentially impact about 120 residents. The district serves about 40 students from 5th through 8th grade.

Spear encouraged anyone seeking additional information on the proposed levy to contact the district at (509) 257-2463.

Ballots must be placed in local drop boxes or postmarked by Feb. 12.